Revamping your business with top-of-the-class insurance technology solutions is pivotal for its growth & for having a free-flowing insurance ecosystem. It can sound daunting, but our certified insurance IT solutions teams, and domain experts will make it a smooth ride. Xangars has in-depth expertise in technology and software engineering in its core DNA, delivering holistic insurance technology solutions and insurance consulting services.

Xangars Insure Supporting Components

The Systems has been providing customized insurance IT solutions to insurers, producers/ intermediaries, insurtechs, and other insurance service providers operating in various geographies. We help you right from discovery to development to support and maintenance.

Xangars Builder

Our Product Management Toolkit (PMT) a module in our Glimpse product lets analysts create and manage Life, Term, Health and Annuity.

Xangars Explorer

Xangars Explore is our analytical tool for book of business level ("what if") analysis and processing activities.

Xangars Reporter

Gain full reporting and analysis for all data stored or imported into the Xangars Insure Platform.

Xangars Monitor

The Xangars production support team proactively monitors all customers’ platform usage 24/7 365.

Stay future-focused in the competitive race to launch insurance products faster

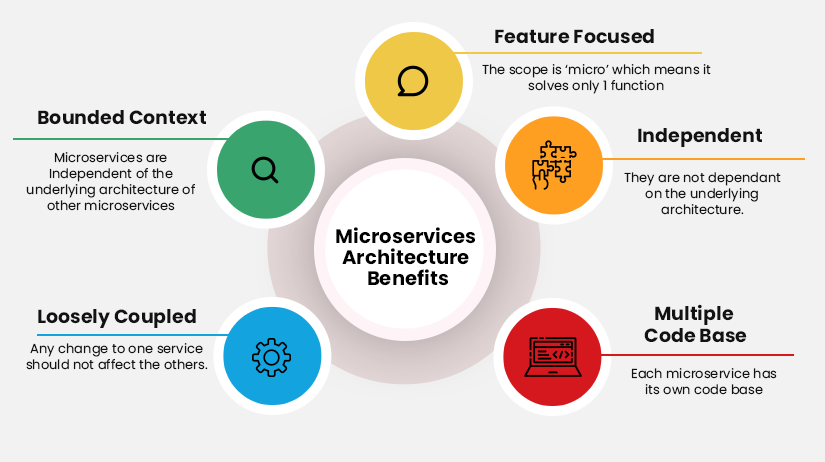

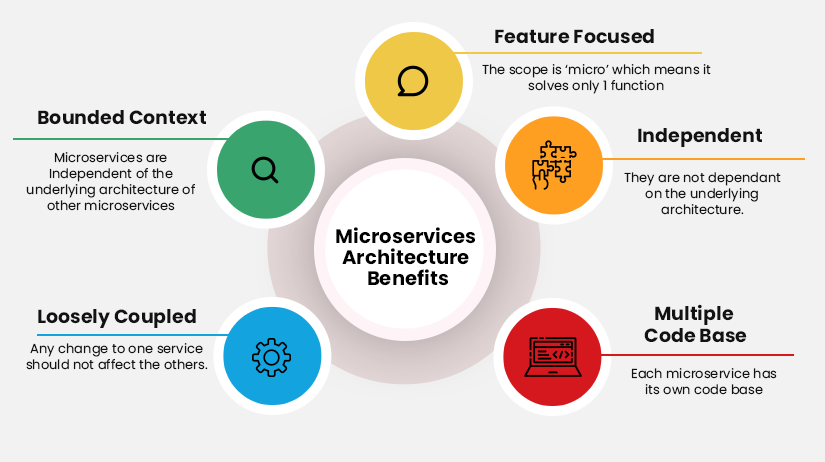

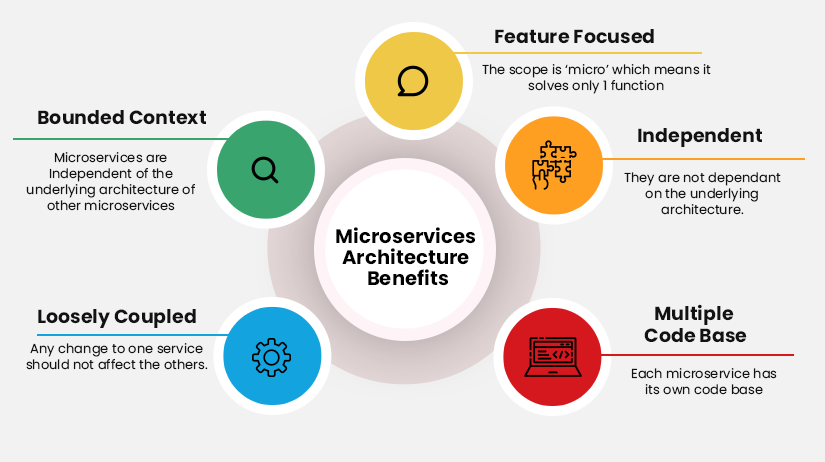

Insurtech startups are driving innovation and disruption in the insurance industry. Use the Xangars microservices architecture to bring your insurance products to market faster and scale your efforts in more critical business initiatives.

Xangars enables insurtechs to launch innovative, high-performing products with microservice architecture. With decades of experience in the insurance industry, we understand that traditional monolithic policy administration systems might not fit your unique needs. With a microservice foundation, you can quickly see your creativity through to the end and cut speed-to-market in half.

Xangars insurance solutions

Life & Health Insurance

Employee Benefits Insurance

Offerings

The journey from development to support involves multiple processes, all of which together make a difference to the output and customer experiences. We have fine-tuned our offerings to suit these individual needs you may have. Couple it with our insurance consulting services and consider your digital insurance transformation journey sorted.

We are different

- Xangars offers all the policy administration microservices needed to build a completely custom, scalable, and API-centric insurance and service contract platform.

- Xangars is redefining policy administration with insurance microservice technology.

- Carriers, managing general agencies, and program administrators are no longer constrained by their monolithic technology platforms.

- They can now replace costly components, extend, orchestrate, and collaborate with third-party providers to create unique API-centric technology platforms and customer ecosystems to simplify the process of purchasing and managing insurance. Experience decreased costs, reduced time to market, and unlimited opportunities for new revenue.

Future-proof your insurance core systems with microservices.

Launch profitable insurance products in a fraction of the time and on budget. You'll also be prepared for inevitable insurance industry changes with modern software architecture.

ISO Electronic Rating Content (ERCTM) is an excellent solution for insurance carriers —enabling them to save over 35% of the cost and 39% of the overall time spent analyzing and interpreting ISO updates. However, taking advantage of this technology requires companies to move on from old, manual ways of doing business and embrace the new paradigm.

Read More

Access our insurance microservices guide.

- An overview of the changing insurance landscape.

- Insurance market pain points that can be alleviated with microservices.

- Driving ROI with microservice architecture.

- An overview of Xangars Insure: microservice-enabled and market-tested policy administration software.

Insuretech’s insurance solutions

Insuretech’s insurance services together make for a digital insurance transformation platform that integrates onboarding, underwriting, claims processing and analytics to provide best-in-class service to customers.This integrated platform has the following accelerators

Insuretech Connect Insurance Accelerator enabling productivity on digital solutions

ACIA is a portal for faster customer onboarding, better customer engagement,personalization, and recommendations.

Know More ->Comprehensive solution platform to improve processes across key areas of insurance business

InsurEdge helps to improve processes across sales & distribution, onboarding, product development, underwriting automation, policy administration, and claims management.

Know More ->AI-based framework for data discovery, segmentation & intelligence, and claim & risk analytics

This AI/ML data-driven framework helps insurers gather insights from varied data sources across the customer journey.

Know More ->Insurance IT services & maintenance solutions

Cloud Transformation

Infra Managed Services ( IT Ops etc.)

Application Modernization

Xangars Insure is a very different kind of policy administration system.

“With microservices and other Insurtech innovations, the insurance industry is now able to rethink how insurance fits into the fabric of our personal and business lives. The ultimate winner will be the customer.”

Xangars Insure is an API-centric policy administration platform built from the ground up on microservice architecture. The platform is deployed in a cloud infrastructure and supports the full policy life cycle process (e.g., submission, rate, quote, refer, bind, ePay, issue, renew, endorse, cancel, reinstate, audit etc.).

Xangars supports all P&C personal and commercial admitted and non-admitted lines of business. Our customers access our microservices through Xangars provided screens or via API calls from their tech platforms.

Since every company has unique policy administration needs, we make our policy life cycle microservices available in three different delivery options:

Xangars Insure Function as a Service (FaaS):

Xangars Insure is an API-centric policy administration platform built from the ground up on microservice architecture. The platform is deployed in a cloud infrastructure and supports the full policy life cycle process (e.g., submission, rate, quote, refer, bind, ePay, issue, renew, endorse, cancel, reinstate, audit etc.).

Xangars supports all P&C personal and commercial admitted and non-admitted lines of business. Our customers access our microservices through Xangars provided screens or via API calls from their tech platforms.

Platform-as-a-Services (PaaS):

This “Xangars Inside” option provides our stateful sales and policy life cycle microservices (accessed through APIs) without the user interface. This option allows your IT team to develop and design the user interface and business flow in-house.

Our sales and policy life cycle microservices are accessed via an XML or JSON request and the return response provides the requested transaction/information. This option allows your IT team (or your digital partners' IT team) to control the project. It reduces the development time and the cost and minimizes project risks as all policy admin functionality and rating content comes pretested and ready to go. Average time to Release Candidate /UAT (your work and our work) 75 days.

Software-as-a-Service (SaaS):

This “total solution” option provides all the needed sales and policy life cycle capabilities (microservices) including the user interface, business flow, required integrations, and reporting database. This option is currently used in consumer portals, broker/agent systems, and full-blown insurance carrier underwriter systems. The average time to Release Candidate (UAT) is 90 days.

Note: These same underlying microservices can also be used in channel partner technology platforms.

Insurance Technology – Moving in the right direction

Roll out insurance products faster and improve the customer experience with state-of-the-art insurance technology.

To succeed in today’s market, insurance companies must evolve their products and meet increasingly sophisticated customer needs. These businesses are turning to technological advancements to reshape their processes, rethink their offerings, and provide an exceptional customer experience.

Several technology trends are expected to have a seismic impact on commercial P&C insurance in the near future. These include:

- Predictive Analytics and AI

- Robotic Process Automation (RPA)

- Microservices

- Use of a Fully Configurable Platform

Predictive Analytics & AI

Insurance companies can collect data from a wide range of sources that were previously unavailable, including IoT and wearables, smart phones, smart homes, and other devices - even online data and social media information can be used for data analytics. This generates valuable insights that are then used to optimize products, services, and brand.

“In addition to reengineering core processes, leading carriers and ecosystem players will use the advent of AI to create products and services based on data and analytics.” (1)

Using data analytics to provide accurate forecasting is set to change insurance as well, by using the data gathered from a variety of sources for ‘what-if” modeling. Insurers can apply future changes across their entire book of business, and measure the effects of different scenarios to improve decision-making.

Predictive analytics can be used by insurance businesses to:

- Improve pricing

- Manage risk

- Anticipate trends

- Improve upselling efforts

- Strengthen brand relationships

Robotic Process Automation (RPA)

Insurance Robotic process automation is the use of low-code, small scripts of code (also known as ‘bots’) that perform simple, repetitive tasks. The value of RPA is that it frees up human workers for higher-level, complex or strategic tasks. In fact, McKinsey estimates that RPA implementation provides 200% ROI within the first year. Another recent study found that successful RPA implementation can help insurance businesses free up 20-30% of capacity. At the same time, RPA significantly reduces human error, which improves the customer experience and reduces organizational risk.

In insurance, RPA can help businesses collect customer information, and auto-fill forms, provide automated follow-up alerts, and flag mismatches or data errors.

Insurance companies rely on a mix of legacy applications and systems. RPA can help link these disparate systems — with minimal coding — so insurers can conduct operations faster, reduce labor costs and explore new areas of business innovation. In fact, Gartner predicts that by 2025, 70% of new applications written by enterprises will use low-code or no-code technologies.

Microservices

Many insurance businesses are bound by the limitations of large-scale, monolithic legacy applications. These are expensive and challenging to maintain, and nearly impossible to integrate with new technologies and applications. The future of insurance is not in building solutions on top of legacy apps, but instead, breaking them down into unbundled, disparate microservices.

Insurance technology that utilizes microservices helps established companies and insurtechs to:

- Use only the services you need to build high-performing products.

- Create unique ecosystems by incorporating third-party and/or partner-provided microservices with your proprietary services.

- Launch innovative insurance products rapidly.

- Enable unrestricted methods to sell insurance products and insurance services: B2C, B2B, Chatbot, channel partner and third-party technology platforms

- Build better customer-facing products: Issue your insurance products with your branding and your unique look and feel.

- Optimize speed and performance: See an increase in application speed and quote delivery by up to 100%.

Use of a Fully Configurable Platform

In the highly-regulated insurance industry, one size does not fit all. Ever-changing regulations, integrating services and technologies and managing all the ongoing insurance product changes make technology investments very risky. Technology that requires customization is problematic, costly, and time-consuming. There is a better way to manage your insurance products - by using a fully-configurable platform.

A fully-configurable insurance platform allows you to rapidly configure all your insurance products and easily maintain them as they change over time. This is all done in a straightforward, non-disruptive environment that is can be mostly be supported by non-technical resources.

Here are just a few examples of what a fully-configurable policy administration platform can do for you.

- Create insurance products (from scratch or from an existing product),

- Create and maintain the product structure and its attributes,

- Manage the states or jurisdictions that you write in

- Manage your insurance product plans and coverages

- Manage rate tables, look up (valid value tables), UI/UX pages and attributes.

- Manage all policy documents and their associated forms.

Insurance Technology and Microservices

Historically, launching niche insurance products from scratch has been problematic for companies as they have had to rely on monolithic software to manage the insurance policy lifecycle. Monolithic systems prevent established insurance companies and insurtechs from using agile methodologies, launching products to market quickly, and avoiding high overhead operating costs.

Future-forward core insurance systems like Xangars Insure utilize microservices to supports the entire quote and policy lifecycle. Using its microservices catalog, companies can choose from a range of specialized applications to find the best functionality for each feature, and ultimately build insurance products to fit any need.

Read MoreTrusted by Top Insurance

Insurance Microservices

Insurance technology has greatly evolved in recent years. With the now widely accepted use of microservice architecture and use of APIs, Insurance Carriers and MGAs can have the technical foundation they need to support and extend their diverse and complex insurance products.

Insurance Carriers, Managing General Agencies, and Program Administrators are no longer constrained by using one monolithic technology platform for their insurance administrative needs. They can now easily create unique cloud-based API-centric technology platforms and customer ecosystems that simplify the management of their distribution partners and customers as well as the purchasing and administration of their insurance policies.

This new “API” approach to technology provides nimbleness, decreased costs, reduced time to market, and provides unlimited opportunities for new revenue and distribution channels.

The majority of our outsourcing relationships begin with a single business process or task, so you can assess our capabilities, the quality of our team, and the accuracy of our work without making a substantial commitment.

Our Microservices Catalog

Xangars Insure is a collection of policy lifecycle services that are built from the ground up on microservice technology. You can use all of our microservices or just the ones you need for your insurance products and users. Our microservices can also be extended to other technology platforms. This allows you to have one set of microservices that can be used in your consumer portals, your carrier, or agency underwriting platforms as well as in your distribution partners’ tech systems.

With Xangars, you are not locked into our screens and business flow. Our microservices are completely decoupled from the user interface, This allows you or Xangars to create your own branded User Interface, look and feel, and business flow. And Xangars microservices can be used on any device; a computer, smartphone, iPad, chatbot, or app

Types of Microservices:

- Rating (stateless/stateful)

- Document Generation Microservice (stateless)

- Transaction Microservice (stateful)

- Workflow Microservices (stateful)

- Utility Microservices (stateless/stateful)

- Product Management Microservices (stateless)

- Metadata Microservices (stateless)

- Custom Microservices (stateless/stateful)

Cloud Infrastructure

Xangars Insure Platform is built using microservices, private and public APIs, DevOps, and agile methodologies.Cloud-native applications are designed to take full advantage of every service including automated testing, deployment, and change control — and we guarantee performance with up-time and issue response time service-level agreements.Our centralized, interoperable services are more secure, flexible and reliable than on-premises infrastructure or a public cloud solution.

Independently Designed, Developed, and Deployed

Dedicated, single-tenant Xangars infrastructure means better control over hardware and software maintenance and updates than with a public cloud provider. Our customized configuration for computing, storage and networking is designed specifically to support the Xangars Platform Microservices architecture. Our security, redundancy, backup and disaster recovery protocols provide you with the peace of mind you need.

Customized Configuration for Deeper Control

Dedicated, single-tenant Xangars infrastructure means better control over hardware and software maintenance and updates than with a public cloud provider. Our customized configuration for computing, storage and networking is designed specifically to support the Xangars Platform Microservices architecture. Our security, redundancy, backup and disaster recovery protocols provide you with the peace of mind you need.

Ensure Security and Reliability with Consistent Monitoring

Xangars offer 24/7, 365-day traffic monitoring, threat detection and DDoS mitigation services. Every transaction is monitored to catch any system exceptions for optimal performance and user experience. Get additional peace of mind with daily transaction reports from our production monitoring team.

Self-Service Toolkit

The toolkit used by Business Analysts to create and manage both Personal and Commercial P&C insurance products in the Xangars Platform.All Xangars Insurance products are developed and maintained in the Xangars Product Management Tool (PMT). The PMT is built specifically for insurance and just like Xangars Insure, the PMT is built with true cloud services and no legacy applications. Here is a high-level overview of the PMT’s components and capabilities:

Create Insurance Products

New insurance products can be either configured from scratch or can be created from other product content, or bureau-based content like ISO ERC. Xangars digitally consumes all the ISO ERC countrywide & state files (and all its versions) into the Xangars platform. (i.e., States, coverages, rate tables, UI/UX pages and their attributes, algorithms, forms selection rules, and stat codes).

Maintain Product(s)

An MGA / Carrier uses the Xangars PMT to manage all aspects of their insurance products; they can adopt or create new product versions, maintain states, coverages, rate tables, lookup tables, UI/UX pages and its attributes (metadata), all policy documents and their associated forms, as well as the processing rules and algorithms.

Test and Promote

Xangars has one environment for development, testing and production. Changes are created, tested, and deployed into production using the PMT by business users without any assistance from DevOps.

Activity Log

Xangars PMT provides a full audit trail of all changes made to insurance products, as well as who performed the changes and when.

Reporting & Data Analysis

Xangars Insure supports full reporting and analysis for all data stored or imported into the Xangars Insure Platform.All data that is associated with the policy administration process and that resides in the Xangars platform (i.e., carriers, agents, LOBs, states, policies, coverages, transactions, premiums, user activity, etc.) is available for reporting. Xangars will work with you during the requirements phase of your project to ensure all data needed for reporting will be available in the Xangars Platform.

Xangars electronically consumes the ISO Electronic Rating Content into our microservices platform within 24 hours of new releases.

Supported Insurance Products

Xangars has cracked the code for automating ISO Electronic Rating Content into your insurance products. We automatically update our platform with the latest updates within one day, so that you can focus on the carrier exceptions unique to you — which you can easily manage in our Self-service Toolkit.

Xangars supports all Commercial and Personal P&C Lines of Business. For all products, Xangars Insure enables product versioning, product cloning, and the reusability of component coverage configurations so you can launch new P&C products in record time.

Newly configured products are provided in our Sandbox early on, so you can test and sign off on them. This, in turn, shortens the implementation timeline and reduces your application testing activities.

Third Party Integration

Insurers can deliver straight-through digital customer experiences with our over 30 pre-built ecosystem partner integrations like ISO Electronic Rating Content, Chase Paymentech, Google Maps, and more. Xangars is always looking for innovative technology to complement and extend Xangars Insure Platform capabilities.

Our Tech Stack

In the Xangars Insure Platform, the UI/UX is completely separate from our business functional components/services as webservices-driven microservices. The UI/UX is an orchestration layer that glues all microservices to quickly build and/or rebuild UI/UX for a different set of user groups if required.

All business layer components are enabled as granular stateless microservices which can be deployed in a clustered environment that provides unlimited scalability. The Xangars Insure Platform components/services are partitioned N+1 tier-based architecture where scalability and extend-ability are unlimited for extending new services/components and for deployment for High Availability (HA).

They support federated architecture which allows orchestration and interoperability between heterogeneous systems with integration over the cloud without dependency with other microservices. They are invokable from any cloud infrastructure platform such as Oracle Cloud Infrastructure (OCI), Azure, AWS, Google Cloud, etc..

They are elastically scalable by themselves without dependencies on other microservices or systems. Each microservice is independently designed, developed, deployed. They run standalone and are maintained on independent clustered environments without dependency with other services.

Each of the Xangars Insure Platform microservices is enabled on top of BPMN 2.0 driven jBPM ruleflows and Knowledgebase servers. Every business service is associated with a business user-friendly BPMN 2.0 driven jBPM ruleflows.

Business Process Outsourcing

We combine best-in-class human resources with Robotic Process Automation (RPA) technology and a Xangars proprietary workflow engine.Xangars customers use our BPO services to support all back-office processing needs. It allows carriers and insurance administrators to hit the ground running for new books of business that are not yet ready for automation or they are used on existing books of business to eliminate the processing challenges of their legacy systems (backlogs, duplicate entry needs, quality problems, resource retention issues, etc.).

Xangars team members work directly with operational and underwriting staff to minimize time-consuming administrative activities. We are experienced in every task associated with insurance policy administration and many other activities.

The majority of our outsourcing relationships begin with a single business process or task, so you can assess our capabilities, the quality of our team, and the accuracy of our work without making a substantial commitment.

CONTACT US

Location:

Xangars Solutions Sdn Bhd (1030545-M) Unit 39-02 (East Wing), Q Sentral, 2A Jalan Stesen Sentral 2 50470 Kuala Lumpur.

Email:

info@xangars.com.my

Call:

+03 5870 5205